Retail Trade Management Overview

=============================

Note : * denotes RTM core functionality

Simplified RTM - Merchandising

==========================

Below is a list of functionality that is available when running Simplified RTM which is part of the Merchandising Standard Edition.

RTM Product/Solution Summary

==========================

High Level RTM Flow

===================

Foundation data setup for RTM includes:

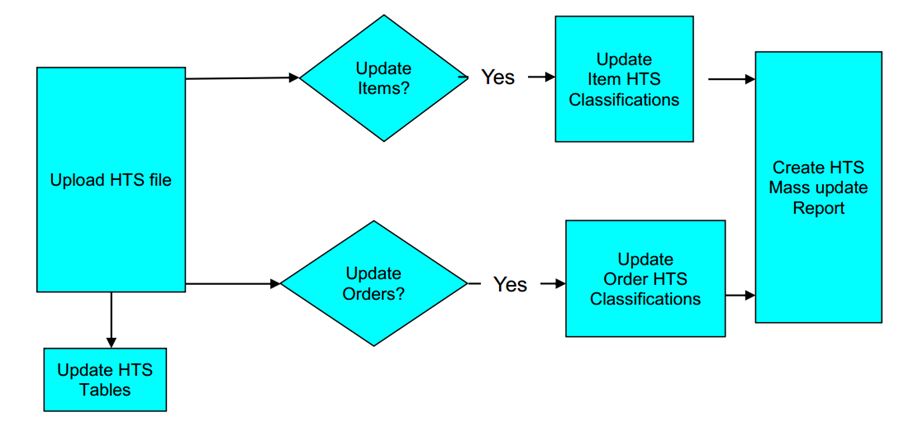

1. HTS codes fileUpload

• HTS (Harmonized Tariff schedule)details can be manually created or uploaded through a flat file which is in Oracle retail file format.

• If HTS codes already exists for item then upon uploading HTS details, HTS details gets updated at item and Order levels.

• The HTS mass update report displays the updated HTS details after HTS upload process.

How do we get the HTS codes file /tapes to upload?

Customs department of each import country will release HTS codes/Tapes every year with updated duty rates. These files can be upload into the system.

2. ELC cost components which affects the cost.

ELC cost components include Expenses, Assessments.

• Zone level expenses incurred when moving goods from a discharge port in the country of import to a final destination (Warehouse).

3. CVB Maintenance - used for complex calculations.

Computation Value Bases describe how expenses and assessments are combined to provide a base for the calculation. Basically CVB’s are used for complex calculations.

4. Expense profiles

• Supplier and partner expense profiles are broken down to “Country” and “Zone”. Country level supplier and partner profiles are for expenses incurred when moving goods from a country of sourcing to the discharge port in the country of import. Zone level profiles are for expenses incurred when moving goods from a discharge port in the country of import to a final destination cost zone (Warehouse or Store).

• A mass maintenance capability exists to change the rate on a cost component in the ELC Cost Component Maintenance, Expense Profiles, and Item Expense dialogs and have it automatically update expense profiles, item expenses, and purchase order/item expenses where applicable on a designated date.

• This is extremely useful for freight rates which change with a fair amount of frequency. Assessment rates are driven by the HTS rate values. When a new file is uploaded items and PO/items can be updated

=============================

- It Is An Import Management System design to Integrate International Trade transactions.

- It is used to manage import process.

- Any Additional cost other than supplier cost will be maintained in the RTM.

- Freight Type Maintenance*

- Freight Size Maintenance*

- SCAC Maintenance (Standard Carrier Alpha Codes)*

- Partner Maintenance (Banks, Freight Forwarders, Manufacturers, Import Authorities, Brokers, Agents, Factories) - Expense Profiles

- Supplier Maintenance– Import Attributes*– Expense Profiles– Documents

- Country Maintenance– Tariff Treatments*– Expense Profiles– Documents

- Outside Location Maintenance Clearing Zones* Lading Ports Discharge Ports

- Document Maintenance (Required Documents, Bank, Sender, and Additional Instructions)

- Cost Component Maintenance (Expenses, Assessments*)

- CVB Maintenance

- HTS Maintenance*– HTS Headings* Documents*– HTS Heading Restraints*– Quota Categories*– Tariff Treatments*– Fees and Taxes*– OGAs (Other Government Agencies) *– HTS Reference*– HTS CVD (Countervailing Duty) and AD (Anti-Dumping) *

- Item Maintenance– Import Attributes*– Eligible Tariff Treatments*–HTS/Assessments*– Documents– Item Supplier – Expenses– Item Supplier Origin Country – Expenses

- Purchase Order Maintenance– Import Attributes– Letter of Credit*– Order Item - HTS/Assessments*– Order Item Location - Expenses– Documents

- Letter of Credit*

- Transportation*

- Obligations*

- Customs Entry*

- Actual Landed Cost (ALC)* Estimates versus Actuals Comparison* Actuals Finalization*

Note : * denotes RTM core functionality

Simplified RTM - Merchandising

==========================

Below is a list of functionality that is available when running Simplified RTM which is part of the Merchandising Standard Edition.

- Partner Maintenance (Banks, Freight Forwarders, Manufacturers, Import Authorities, Brokers, Agents, Factories)

- Expense Profiles

- Supplier Maintenance- Import Attributes* Expense Profiles Documents

- Country Maintenance- Tariff Treatments* Expense Profiles Documents

- Outside Location Maintenance Clearing Zones* Lading Ports-Discharge Ports

- Document Maintenance (Required Documents, Bank, Sender, and Additional Instructions)

- Cost Component Maintenance (Expenses, Assessments*)

- CVB Maintenance

- HTS Maintenance - * HTS Headings*o Documents -* HTS Heading Restraints* Quota Categories* Tariff Treatments* Fees and Taxes* OGAs (Other Government Agencies) * HTS Reference* HTS CVD (Countervailing Duty) and AD (Anti-Dumping) *

- Item Maintenance Import Attributes* Eligible Tariff Treatments* Documents HTS/Assessments* Item Supplier – Expenses Item Supplier Origin Country - Expenses

- Purchase Order Maintenance Letter of Credit* - This dialog is available with Std. Edition, but it is not required when an Order’s Payment Method is ‘Letter of Credit’ Order Item - HTS/Assessments* Order Item Location - Expenses Documents

- Letter of Credit* - This dialog is available with Std. Edition, but it is not required when an Order’s Payment Method is ‘Letter of Credit’

RTM Product/Solution Summary

==========================

High Level RTM Flow

===================

Foundation data setup for RTM includes:

1. HTS codes fileUpload

• HTS (Harmonized Tariff schedule)details can be manually created or uploaded through a flat file which is in Oracle retail file format.

• If HTS codes already exists for item then upon uploading HTS details, HTS details gets updated at item and Order levels.

• The HTS mass update report displays the updated HTS details after HTS upload process.

How do we get the HTS codes file /tapes to upload?

Customs department of each import country will release HTS codes/Tapes every year with updated duty rates. These files can be upload into the system.

2. ELC cost components which affects the cost.

ELC cost components include Expenses, Assessments.

- Expenses are broken down to “Country level” and “Zone level”.

• Zone level expenses incurred when moving goods from a discharge port in the country of import to a final destination (Warehouse).

- Assessments specifically refer to taxes, fees, or duties which are paid to the government. The tax, fee, and duty assessments roll up to become a landed cost component.

3. CVB Maintenance - used for complex calculations.

Computation Value Bases describe how expenses and assessments are combined to provide a base for the calculation. Basically CVB’s are used for complex calculations.

4. Expense profiles

• Supplier and partner expense profiles are broken down to “Country” and “Zone”. Country level supplier and partner profiles are for expenses incurred when moving goods from a country of sourcing to the discharge port in the country of import. Zone level profiles are for expenses incurred when moving goods from a discharge port in the country of import to a final destination cost zone (Warehouse or Store).

• A mass maintenance capability exists to change the rate on a cost component in the ELC Cost Component Maintenance, Expense Profiles, and Item Expense dialogs and have it automatically update expense profiles, item expenses, and purchase order/item expenses where applicable on a designated date.

• This is extremely useful for freight rates which change with a fair amount of frequency. Assessment rates are driven by the HTS rate values. When a new file is uploaded items and PO/items can be updated

5. Documents

- Documents can added at different levels I.e. supplier / partner / country / item /PO.

- IF the documents are added at higher level they will be updated to the lower levels.

6. Outside Locations

Outside locations are the location that are located outside the system where inventory will not be tracked. They are used in expenses profiles and updates the expenses based on lading and discharge ports.

7. Freight type /size

Freight type and freight size information basically used in transportation. This details will help Salam in to know which merchandise is coming in which freight and what type of freight it is.

These are Freight types:

• 20’ foot container.

• 40’ foot container, etc.

Below are the freight types that can be noted on the Bill of Lading:

• CFS/CFS: Container Freight Station to Container Freight Station

• A type of steamship line service in which cargo is transported between container freight stations, where containers may be stuffed, stripped, or consolidated. Usually for less than container load shipments.

• CY/CY: Container Yard to Container Yard

• A type of steamship line service in which freight is transported from origin container yard to destination container yard.

• LCL: Less than Container Load

• Usually LCL cargo is consolidated with other small lots for shipment by container.

• LTL: Less than Truckload

• Similar, used more in domestic freight movement.

8. Standard Carrier Alpha Codes (SCAC) Maintenance

A unique code used to identify transportation companies. It is typically two to four alphabetic letters long. Developed by the National Motor Freight Traffic Association in the1960s to help the transportation industry computerize data and records. The container can have a different SCAC code than the vessel. In RTM the container SCAC is entered in the Transportation Maintenance – Freight window.

Example:

FDEG FEDEX GROUND

FDEN FEDEX (AIR)

FEXF FedEx Freight

FXFE FedEx LTL Freight East

FXFW FedEx LTL Freight West (formerly VIKN - Viking)

FXNL FedEx Freight National (formerly Watkins)

How SCAC codes are useful?

This is another level of tracking the goods during the transportation, SCAC code information could be useful to identify the containers of a particular freight forwarder.

ItemMaintenance

==============

1. Documents

• Documents can be added at items level which will updated on to the PO.

2. HTS/Assessments

•Initially HTS codes need to be attached manually for each item, during HTS upload HTS detail will be updated for all the item/HTS combination.

3. Eligible Tariff treatments

• Tariff treatments completely depends on the agreements between the countries.

• Example: The import duty between GCC countries would be zero like free trade, another example if any client importing the goods from India, based on the agreements between India and Qatar tariff treatments would differ.

4. Item supplier Expenses

• Expenses can be added at item level and gets updated onto the PO. Expenses added at this level are called Zone level expenses .expenses which are incurred from discharge port to cost zone locations are called zone level expenses.

5. Item supplier origin country –expenses

• Expenses can be added at item level and gets updated onto the PO. Expenses added at this level are called country level expenses .expenses which are incurred from lading port to discharge port are called country level expenses.

PO Maintenance

==============

1. Order item- HTS /Assessments.

• As soon as item added to PO, HTS /assessments details gets updated on to the PO.

2. Order item Location – expenses

• Expenses on the order can be added using partner’s/lading /discharge port combinations or if items already have expenses then expenses will be updated automatically.

Transportation

=============

• Transportation details can be upload through a flat file.

• Transportation information is used to track the items during transportation at many levels

• Example: BOL number, Lot no, Seal ID, SCAC codes, freight size, freight type and Packing list information.

• Finalizing the transportation will create a customs entry records automatically.

Customs entry

============

• Client can maintain customs entry information for all import countries in custom entry module. This module also records the different types import duties paid to the government.

• When the transportation records are finalized, a Customs Entry is automatically created using information from the transportation record. This process ensures consistent and accurate data.

• Custom entry charges can be changed in custom entry module which would affect the weighted average cost of an item.

• Once the Customs Entry is completed, Salam studios & stores can choose to allocate the duty and assessment to Actual Landed Cost (ALC).

• When the Customs Entry is Confirmed status, a non-merchandise invoice will be created automatically in Oracle Retail Invoice Matching.

Obligation

==========

• Obligations are invoices typically provided by partners (e.g. Freight forwarder, agents, etc.) and/or suppliers that capture the actual expenses incurred to bring the item from origin country to final destination (Warehouse).

• Since Estimated Landed Cost (ELC) is only an estimate of the expenses incurred, the actual expenses (actual landed cost-ALC) can be captured to ensure that any variance between ELC and ALC is recorded and (optionally) allocated to the item’s costs.

• Negative obligation can also be added only if there is user error during entering the value.

• If the actual expenses are not equal to estimated expenses a cost adjustment will be generated for ELC / ALC difference and posted to stock ledger

• Approved and allocated obligations in Oracle Retail Trade Management will generate non-merchandise invoices in Oracle Retail Invoice Matching.

• The actual obligation costs can be allocated to item/loc through the ALC module.

ALC Finalization

• Actual landed Cost (ALC) is the sum of all actual expenses and assessments involved in bringing an item on a particular purchase order from the origin country to the final destination.

• The incurred expenses are received in the form of Obligations provided by partners or suppliers. Incurred duties, in the form of assessments, are received and recorded through Customs Entry. ALC amounts can be viewed at the PO, PO/Item, shipment or entry level.

• Client can easily view the variance between the Estimated Landed cost (ELC) and ALC.

• After analysis, Salam studios & stores have the option to finalize the actual landed costs. ALC finalization will update the stock ledger and WAC appropriately based on the actual cost instead of the estimated cost if inventory exists for the item/location.

• If inventory does not exist for the item/location a cost variance record will be written to update the GL but not the stock ledger.